In a move that will create better returns for pensioners through reduced investment management fees and provide increased pension security for public servants, the government has challenged Manitoba public-sector funds to buy their investment management services together as a group. This is a smarter shopping move that could easily realize $200 million or more in additional annual return of total assets.

Manitoba currently has multiple externally managed pools of funds consisting mostly of pension plans, valued at approximately $40 billion.

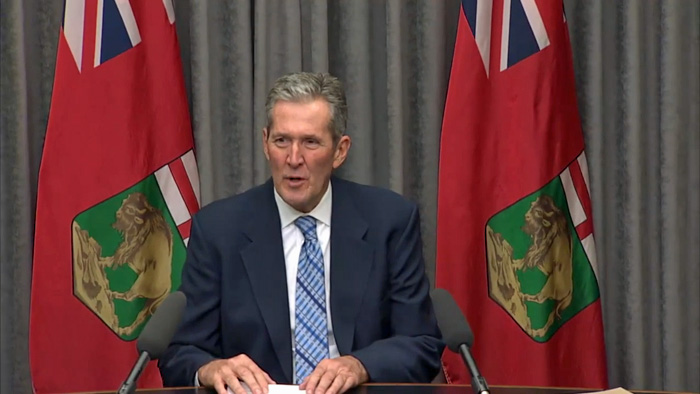

“By centralizing the funds’ investment management, we can achieve economies of scale, leading to improved financial gains for pension plans, while leaving more money on the tables of pensioners and workers,” said Premier Brian Pallister.

The siloed nature of investment management of Manitoba pension assets has resulted in higher costs and lower yields for investors. A change like this will increase both savings and benefits, said Pallister.

“In Manitoba, we have not empowered pension plans to be smart shoppers when it comes to the investment management of this basket of funds. Once pension plans co-ordinate their investments, we can generate better returns that will benefit pensioners and public servants,” Pallister added. “This is about shopping smarter.”

The Manitoba government will meet with the pension funds in the coming weeks to encourage collaboration. The pension funds will be tasked with returning to government with a joint recommendation by March of 2020.

“We have a significant opportunity for pension plans to reduce the fees they are paying today to managers in places like Toronto and New York. By reducing these costs, getting better returns and having access to new types of investments only available larger pension plans, we will improve the sustainability of these plans,” said Pallister. “This will also reduce the need for higher contribution rates in the future.”