The Manitoba government is making investments that will bring total tax and affordability measures to more than $1.8 billion between 2022 and 2024, providing $5,500 in total savings for the average two-income family by 2024.

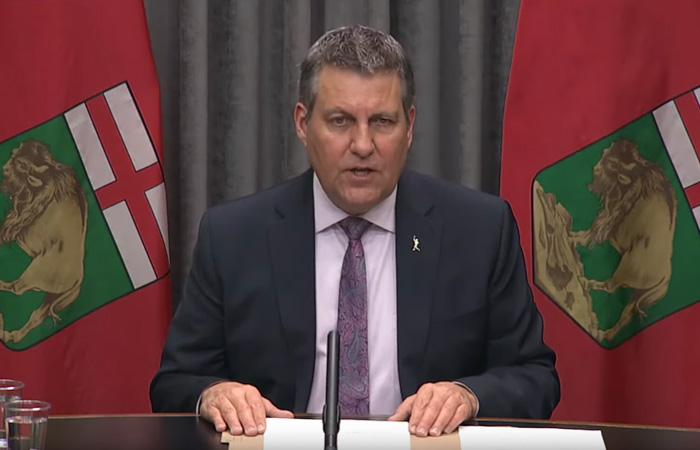

“We have a Low Tax Plan to make Manitoba a more affordable place to live, and a more competitive place to do business,” said Finance Minister Cliff Cullen. “This means creating a positive atmosphere for economic development with new opportunities for Manitoba businesses to grow. Our historic tax relief will help the economy prosper because we understand that affordability and tax competitiveness is the key to creating good local jobs for Manitobans.”

This year, the School Tax Rebate for residential and farm properties increases to 50 per cent in 2023 from 37.5 per cent in 2022. The average rebate to a homeowner will increase to $774 in 2023 from $581 in 2022. Rebates are delivered the month in which municipal property taxes are due and will begin being received in Winnipeg and Brandon in June.

Owners of other properties including commercial, industrial, institutional properties will receive a 10 per cent rebate of the total of both the school division special levy and the education support levy payable.

“It would be naive to understate the importance of Manitoba’s grocers to our provincial economy,” said John Graham, prairie director, Retail Council of Canada. “These primarily national brands provide over 17,000 jobs, pay tens of millions of dollars in annual taxes, support hundreds of charities, as well as being critical champions of Manitoba growers and food producers. Arbitrarily determining who receives a rebate on the taxes they pay based on who owns a company or the size of their contributions to Manitoba’s economy not only undermines the importance of fairness and trust, it’s simply bad tax policy. Tax rebates allow retailers to lower prices, create jobs and invest in their businesses.”

To learn more about the School Tax Rebate, visit gov.mb.ca.